How To Find My Business Vat Number

How you contact the national authorities varies from country to country. If the VAT number is valid or not.

Telangana Sales Tax Registration Certificate Accounting Taxation Sales Tax Registration Tax

You must register your business for Value Added Tax VAT if the total value of taxable goods or services is more than R1 million in a 12-month period or is expected to exceed this amount.

How to find my business vat number. Most businesses can register online - including partnerships and a group of companies registering under one VAT number. Add up all the values obtained after multiplying each value of the VAT number. It may also appear on other documentation such as insurance forms or claims.

Is the German term for the VAT number. Results are limited to a maximum of 19 possible companies in the results list. The first document to get the VAT number of another business is to look at the invoices that are supplied to you.

To find a VAT number look for two letters followed by a hyphen and 7. Terms and Conditions The VAT Vendor Search is subject to the general Terms and Conditions of SARS e-Filing. Using a Trading Name to find the VAT Number Enter a minimum of 5 characters to get a listing of possible matches continue to add characters to the search criteria until it narrows the results to the trade name you looking for.

Confirming the correct VAT Number. You can find your NZBN on the Companies Register or by searching at nzbngovtnz. A VAT number is a value-added tax identification number that allows governments to track the VAT activity of registered businesses.

VAT Vendor Search To use the VAT Vendor Search facility you must have 128 bit encryption installed on your browser. A New Zealand Business Number NZBN is a globally unique identifier available to all Kiwi businesses. Users must please note that the database is updated weekly.

BE - Belgium -. The VAT number Umsatzsteuer-IdNr The Umsatzsteuer-Identifikationsnummer USt-Identifikationsnummer or USt-IdNr. Businesses can find their own number on the VAT registration certificate issued by HMRC while the numbers for other businesses should be stated on any invoice they issue.

List the VAT number vertically excluding the first two letters that is excluding the country code. By doing this youll register for VAT and create a VAT. Look at an invoice issued by the company to find the VAT number The VAT number of the company you are dealing with will most likely be on the invoice it has released to you.

Registered companies have been allocated NZBNs and are automatically included on the NZBN Register. If your supplier is registered for VAT then chances are its unique VAT identification number will be. An example of this is below.

A VAT number or VAT registration number is a unique code issued to companies which are registered to pay VAT. AT - Austria - 9 characters always starting with a U. There are a number of places to look in order to find the VAT number of another business.

If you cannot find the information on VIES you should request more information at national level with your national authorities. If you are a UK VAT-registered business you can also use this service to prove. You should then be able to confirm.

What does a VAT number look like. Then multiply each value of VAT registered number starting with 8 and ending with 2. If youve already had correspondence with them such as a previous invoice the number should be on there.

These activities include VAT paid tax credits earned and VAT taxes charged and collected from customers. VAT numbers in the EU consist of 15 alphanumeric characters with the first two indicating the country of the registered business - eg GB for the UK. Then deduct 97 from the total sum until the answer becomes negative.

The name and address of the business the number is registered to. All the countries in the EU are currently as follows with their two letter country codes. If the VAT number is associated with a certain name and address.

FR 295849305 In the above example the first two letters identify the country where the parcel is heading. Currently a VAT number is around nine characters long with a mixture of letters and numbers which indicate various unique features of the parcel. Where to find a business tax number You can usually find a business Steuernummer on their website in their Impressum.

Use this service to check. Check a UK VAT number. A business may also register voluntarily if the income earned in the past 12-month period exceeded R50 000.

If the business youre dealing with is VAT registered you can easily find its VAT ID on its invoices.

Eu Vat Number Extension For Woocommerce Woocommerce Numbers Error Message

Check An European Vat Number Using The Vat Vies Service Valdit

3 Simple Ways To Find A Company S Vat Number Wikihow

Check An European Vat Number Using The Vat Vies Service Valdit

My European Vat Number Is Not Validated What Can I Do Press Customizr Documentation

Vat Registration Income Tax Capital Gains Tax Tax Forms

Value Added Tax Vat Infographic In 2021 Value Added Tax Ads Tax

Wat Is Een Vat Nummer Uitleg En Voorbeeld Zzp Daily

3 Simple Ways To Find A Company S Vat Number Wikihow

Why Your Mindset Is So Important When It Comes To Managing Your Business Finances The Independent Girls Collective Business Finance Financial Coach Finance

Vat Number Checker Eu Norway Switzerland Thailand Free

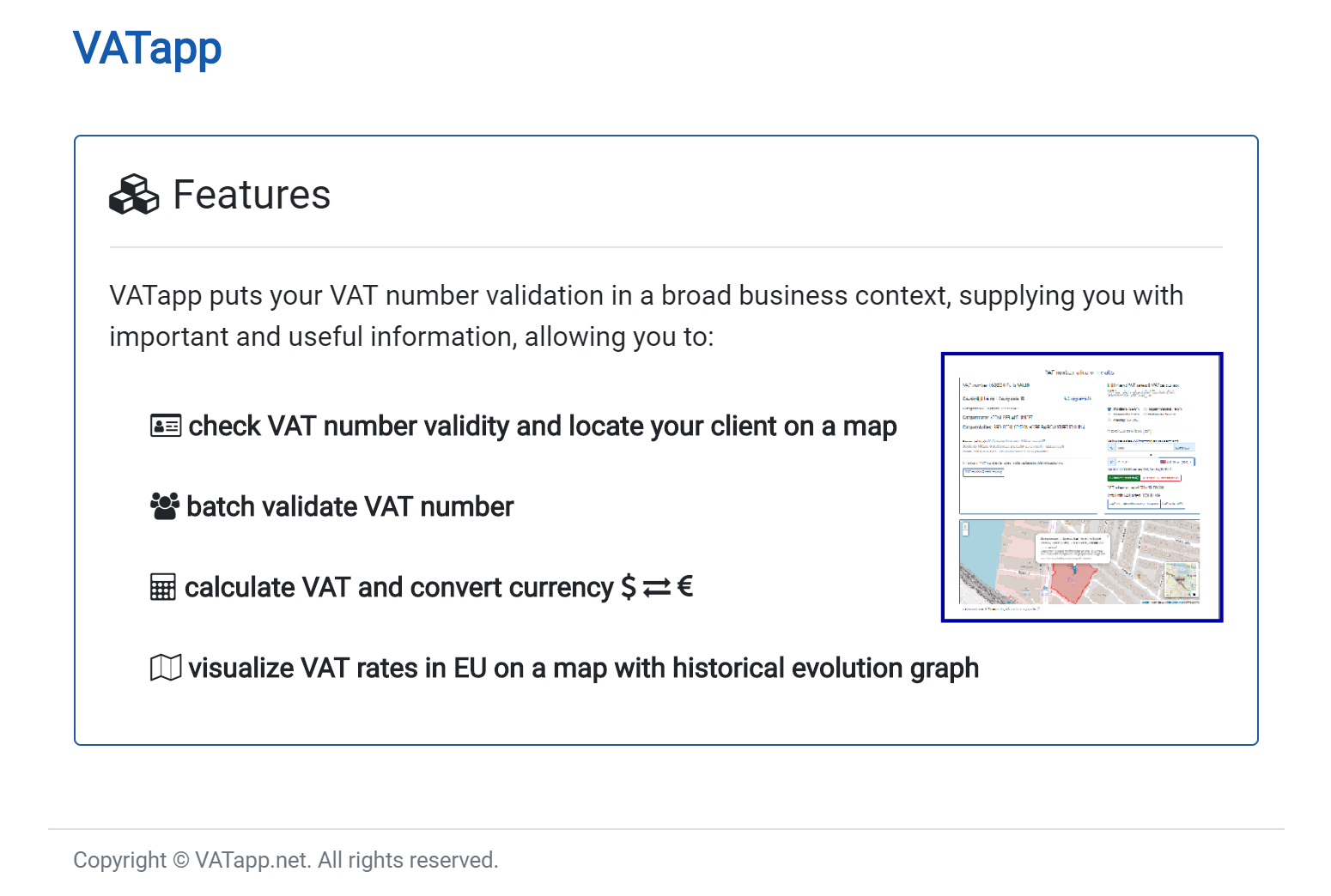

Automatic Vat Validation For Eu Sap Blogs

3 Simple Ways To Find A Company S Vat Number Wikihow

All You Need To Know About Vat Registration Process In Uae And Saudi Arabia Read About Rules Forms Documents Online Registration Registration How To Apply

Vat Rate Of Different Countries In 2021 In 2021 Different Countries Rate Country

Post a Comment for "How To Find My Business Vat Number"