Vat Department Business First

Most of the forms are in PDF format which require the use of Adobe Acrobat for download. You may view all forms for this agency or see forms based on your specific topic of interest.

12 Organization Of The Vat Administration In The Modern Vat

Our helpdesk hours are 9am to 5pm Monday to Friday.

Vat department business first. To set the system up for manual VAT entry in a general journals. Business First As from 2nd April 2018 the Office of the Commissioner for Revenue will be providing VAT and Income Tax customer care services for businesses from the new Business 1st premises at entru Joseph Grech Floor 2 Cobalt House Notabile Road Mrieel BKR 3000 and NOT from BKara. Any person who owns or operates a business in The Bahamas is required to apply for and obtain a business licence in compliance with the Business Licence Act 2010.

Opening Hours - Business First. Supporting documents and approvals from other agencies are required when completing the online. He has been seconded from Malta Enterprise where he has been in charge of a number of Departments since joining in 2004.

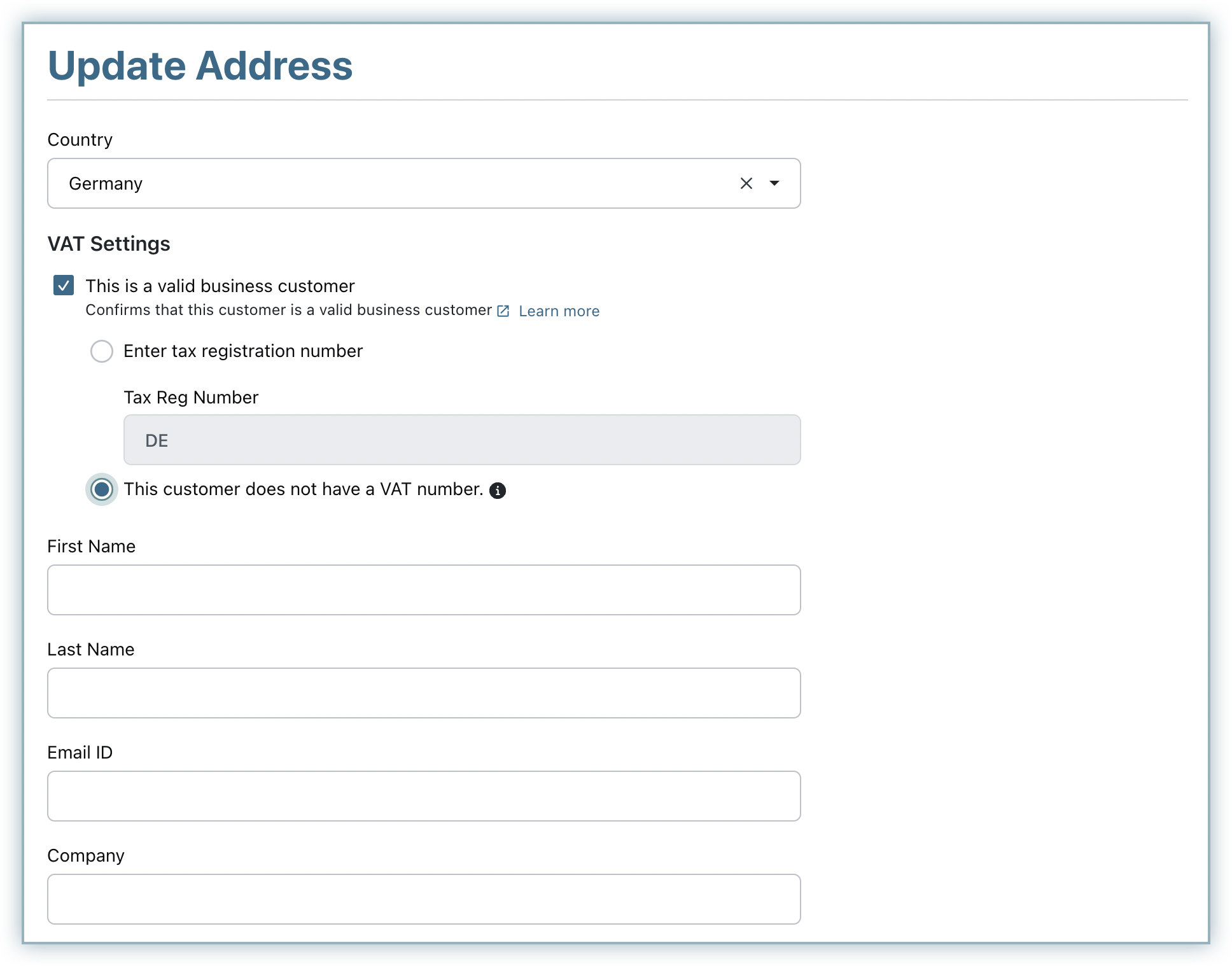

Once you have registered your business you will need to request a new VAT number from the Office of the Commissioner of Revenue. Currently in the United Kingdom the standard rate of VAT or Value Added Tax is 20. You must register your business for VAT with HM Revenue and Customs HMRC if its VAT taxable turnover is more than 85000.

For example you might need to do this when you enter a vendor invoice in your journal and there is a difference between the VAT amount that Business Central calculated and the VAT amount on the vendors invoice. The following entities are not meeting customers at Business 1st for the time being. When you register youll be sent a VAT registration certificate.

07012021 - Brexit_On-going movements of goods from the United Kingdom to the Republic at the moment of its withdrawal on 31122020. In the EU a VAT identification number can be verified online at the EUs official VIES website. Paul Baldacchino is the Chief Officer at Business First and has been instrumental in the setting up of Business First.

This is the amount of tax a customer pays on the total cost of the product. This procedure can be carried out online through the following link. VAT Act replaced the Goods and Services Tax GST which was almost similar tax on the consumption of goods and services.

When we talk about VAT were referring to Value Added Tax. Alternatively companies and self-employed can call at Business First. Chief Officer Business First.

It is a tax on domestic consumption of goods and services. Forms Online is your access to hundreds of government application forms and Information. As from 2nd April 2018 the Office of the Commissioner for Revenue will be providing VAT customer care services for businesses from the new Business 1st premises and NOT from the VAT Offices BKara.

VAT numbers to register with the Revenue Department VAT Department in the event that the business activity is taxable. If you are having difficulties logging in or would like help using any part of this website do not hesitate to contact us. Accordingly the VAT rate was revised to 8 from a previous 15 with effect from 1st December 2019.

07012021 - Brexit_ VAT Refunds undre Directive 20089 refunds to taxable persons in other member states for business expenses incurred in the United kingdom. It confirms that the number is currently allocated and can provide the name or other identifying. However the VAT applicable to financial services remains at 15.

Identity Malta TCN appqueries Fridays till 1300 Environmental Health Directorate Daily Customs Thursdays till 1300 Business Enhance ERDF Grant Schemes Wednesdays 1400- 1900 by appointment. Applications are completed online at vatrevenuegovbs. This guidance will provide you with the necessary background to determine whether a supply is treated for VAT purposes as a supply of financial services and whether that supply then falls to be.

You can also adjust VAT amounts in general sales and purchase journals. This is simply a consumption tax that is placed on either a product or service at each stage of its supply chain. Value Added Tax VAT is introduced by the Act No14 of 2002 and is in force from 1st August 2002.

All registrations for VAT must be completed and submitted online. PE number - to register as an employer with the Revenue Department Inland Revenue Department in the event that the activity will entail the engagement of employees during the initial stages. VAT Customer Care Services Integrated Within Business 1st.

A value added tax identification number or VAT identification number VATIN is an identifier used in many countries including the countries of the European Union for value added tax purposes.

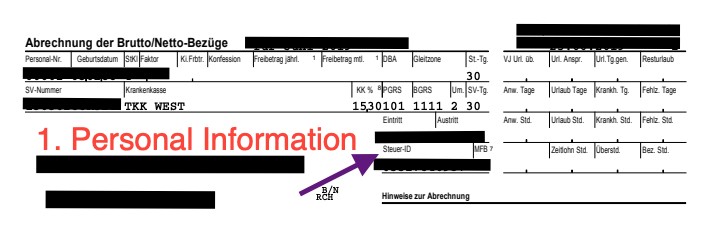

Tax Number And Tax Id In Germany What S The Difference

Vat Utap Office 52d Force Support Squadron Spangdahlem Air Force Base

Vat For Bands Musicians Everything You Need To Know

Bzst Electronic Data Transmission

How To Start A Business In Germany All About Berlin

Vat Utap Office 52d Force Support Squadron Spangdahlem Air Force Base

Vat Utap Office 52d Force Support Squadron Spangdahlem Air Force Base

12 Organization Of The Vat Administration In The Modern Vat

12 Organization Of The Vat Administration In The Modern Vat

Vat Utap Office 52d Force Support Squadron Spangdahlem Air Force Base

Post a Comment for "Vat Department Business First"