How To Register A Small Business For Vat

Anzeige Streamline your multi-country EU VAT registration requirements into one single return. Submit the registration form to your local SARS branch within 21 days from date of exceeding R1 million.

Guide Starting A Business In The Netherlands Ics

Anzeige Streamline your multi-country EU VAT registration requirements into one single return.

How to register a small business for vat. Whether you need information on registration submitting VAT and staying compliant or just some of the common VAT terms explained its all here. Take our business impact survey and find out which VAT returns you need to file. If you do choose to register for VAT youll need to send VAT returns to the HMRC four times a year and increase the amount that you charge for your products.

In the UK you need to register your business for VAT if your VAT taxable turnover exceeds 85000. VAT stands for Value Added Tax which is a type of tax on the consumption of goods and services. Post you can get the relevant written forms from your accountant.

How to register for VAT. Most businesses can register online - including partnerships and a group of companies registering under one VAT number. If youre a VAT -registered business you must report to HM Revenue and Customs HMRC the amount of VAT youve charged and the amount of VAT youve paid.

Our comprehensive free VAT guide has lots of advice and guidance to get you started. By doing this youll register for VAT and create a VAT online account. Theyll be able to work out the most tax efficient way to pay VAT.

Once your business is registered for VAT youll gain access to the part of the Govuk website that will let you complete your VAT returns. Visit the SARS websitewwwsarsgovzaand click eFiling then REGISTER NOW. Businesses pay VAT on purchases and charge customers VAT.

One of the major downsides to registering is the cost of compliance. From the VAT point of view the year is generally split into quarters meaning that youll need to log in to the website four times per year to submit an online VAT return. A small business that is registered as a micro business under the Sixth Schedule of the Income Tax Act may also register for VAT and may elect to submit returns and payments every four months ending on the last day of June October and February.

Registering online is much simpler and means that you wont need to change your VAT process in the future. Remember that you must do this if your VAT taxable turnover is over 85000. Registration of a new business.

There is a limited range of goods and services which are subject to VAT at the zero rate or are exempt from VAT. If you have set up a business but have yet to supply taxable goods or services you may reclaim VAT on your start-up costs. You have to register when you know that your.

This is done through your VAT. Then add up all the sums you have and deduct 97 from the sum until the answer is negative. To avail of this facility your business must be established in the State.

What registration forms should you complete online. Any business may choose to register voluntarily if the income earned in the past twelve month period exceeded R50 000. This will enable you to obtain credit for VAT on purchases made before trading begins.

For UK VAT numbers do the following exercise. To register for eFiling. Excluding the first two letters list the numbers vertically and multiply each by a value starting with 8 and ending with 2.

VAT is levied at a standard rate of 15 on the supply of goods and services by registered vendors. Youll be given a VAT number. Online visit HMRCs website.

So I registered for VAT straight away. How long does it take to register for VAT. Register online through ROS You or your tax agent can register your business for VAT through Revenues Online Services ROS.

Take our business impact survey and find out which VAT returns you need to file. Once registered youll receive a VAT registration certificate confirming your VAT number and when your first VAT return and payment are due. If you have a Government Gateway ID.

Even if your business earns less than the small business VAT threshold you can still register for VAT. How to register for VAT. Or If you are trading as a Sole Trader or in Partnership - Download the SARS MobiApp from the Google Play Store Android or App Store Apple devices and tap onREGISTER.

If you dont have a valid number then your business can not re-claim the VAT. Go to the Register for HMRC taxes page select the appropriate option then click the next button to go through the pages. There are two ways to register for VAT.

All companies with an annual turnover greater than Dh375000 must mandatorily register and account for VAT while businesses with an annual turnover of between Dh187500 and Dh375000 can voluntarily register. However to do so you are required to register for VAT. On the final page select I have an account login.

Select VAT and follow the final steps to complete your VAT registration application. We know that managing VAT can be a pain for many small businesses but it doesnt have to be. You can register for VAT online at the governments website.

It is money that youre able to keep in your business and providing youre cautious about how you manage that money you do get a a little bit of payback and that money is yours.

How To Register For Vat In India Quickbooks India Small Business Center Quickbooks Business How To Apply

Value Added Tax Vat Infographic In 2021 Value Added Tax Ads Tax

Vat The Basics Company Structure Opening A Bank Account Small Business Accounting

Impact Of Uae Vat On Individuals Vat Registrations Accountantsbox In 2021 Vat In Uae Global Organization Inventory Accounting

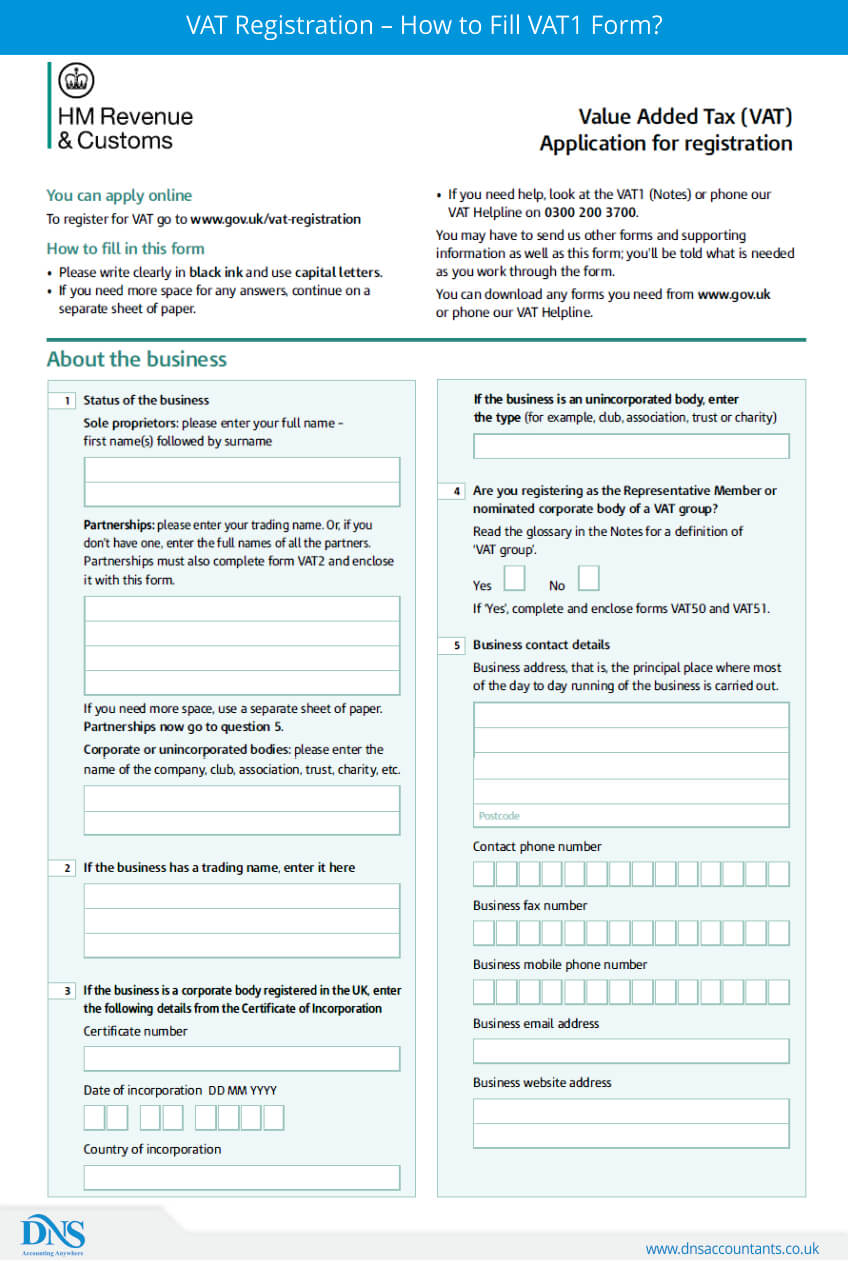

Vat Registration How To Fill Vat1 Form Dns Accountants

Common Mistakes Made By Sme For Vat Filing In Uae Vat In Uae Uae Sme

When Do You Need To Register For Vat Startups Co Uk Starting A Business Advice And Business Ideas Business Advice Starting A Business Do You Need

Should I Register For Vat Beyond The Oven How To Raise Money Small Business Finance This Or That Questions

Find Out When And How You Can Register Your Online Business For Vat And How You Can Reclaim Vat On Business Related Purchases Online Business Business Online

Vat Registration Steps In Uae Vat Registration Dubai Uae Vat In Uae Dubai

How Do I Register For Self Assessment In The Uk Rainysfinancials Bookkeepingforsmallbusin Self Assessment Small Business Bookkeeping Small Business Finance

Vat Scheme For Small Businesses

Download Uk Vat Purchase Register Excel Template Exceldatapro Excel Templates Templates Excel

Do I Need To Register My Business For Vat Youtube

Vat Threshold 2021 When To Register For Vat Hellotax

Advice On Vat Registration Value Added Tax Eligibility Process For Registration Accounting Services Inventory Accounting Vat In Uae

Do You Search For This Changes Everything Capitalism Vs The Climate This Changes Everything In 2020 Small Business Accounting Register Small Business Business Account

Post a Comment for "How To Register A Small Business For Vat"